How to Earn 25% Per Month with Auto-Arbitrage in the Cryptocurrency Market

Exploiting Price Discrepancies to Make Profits

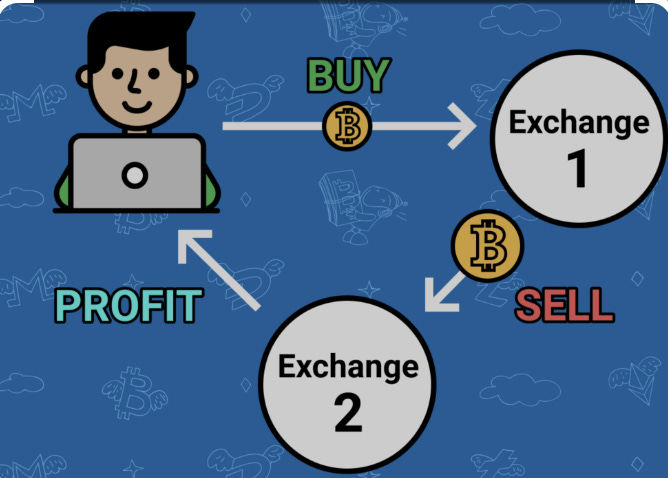

Arbitrage is the practice of buying and selling an asset in order to take advantage of price discrepancies in different markets. It is a common strategy used by investors and traders in order to profit from the inefficiencies present in the market. With the emergence of cryptocurrencies, arbitrage opportunities have become more prevalent, and traders have been able to take advantage of these opportunities to make significant profits.

One of the primary reasons why arbitrage opportunities exist in the cryptocurrency market is due to the lack of regulation and the presence of multiple exchanges. Unlike traditional financial markets, the cryptocurrency market is decentralized, and there is no central authority overseeing the prices of different cryptocurrencies. This lack of regulation has led to price discrepancies between different exchanges, which can be exploited by traders through arbitrage.

For example, let's say that the price of Bitcoin is $10,000 on Exchange A and $10,500 on Exchange B. A trader can buy Bitcoin on Exchange A for $10,000 and then sell it on Exchange B for $10,500, pocketing a profit of $500. This type of arbitrage is known as "simple arbitrage," and it is relatively easy to execute as long as the trader has the capital to buy the asset on one exchange and sell it on the other.

Another type of arbitrage that is popular among cryptocurrency traders is known as "triangular arbitrage." This involves taking advantage of price discrepancies between three different currencies. For example, let's say that the price of Bitcoin is $10,000, the price of Ethereum is $1,000, and the price of Litecoin is $100. A trader can buy Bitcoin with their US dollars, exchange the Bitcoin for Ethereum, and then exchange the Ethereum for Litecoin. If the prices of these three cryptocurrencies are not perfectly aligned, the trader can profit from the discrepancies.

Arbitrage can be a lucrative strategy for traders who are able to take advantage of price discrepancies in the market. In order to be successful with arbitrage, traders need to be able to act quickly and have the necessary capital to execute trades.

In conclusion, the power of arbitrage in the cryptocurrency market lies in the ability of traders to profit from price discrepancies between different exchanges and currencies. By taking advantage of these discrepancies, traders can make significant profits, provided they are able to act quickly and have the necessary capital to execute trades.

WATCH VIDEO EXPLAINER